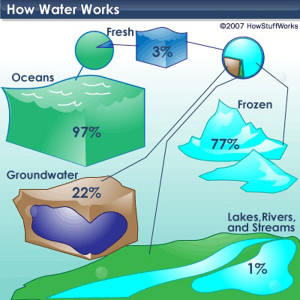

The diagram ‘How Water Works’, shows how water recycles itself on our planet on a regular basis.

Lately this ‘regular basis’ has changed dramatically. We have entered a few years ago an age of drought and as our populations grow our amounts of water consumption and waste have grown. Interestingly enough, those people who have less water are the ones who will least waste it.

We have to train ourselves to respect water and with it the idea of life in this shrinking world.

Below are some ways of rescuing and recycling grey water as well as clean potable water. By definition, Grey water is lightly used water from the bathroom sinks, showers, tubs, and washing machines. It is not water that has come into contact with feces. Grey water may contain traces of dirt, food, grease, hair, and certain household cleaning products. In some cases this grey water may be considered as organic.

General

• Never pour water down the drain when there may be another use for it such as watering a plant or garden, or for cleaning around your home.

• When using the faucet make it a habit to keep one hand on it to minimize waste.

• Most residential water can be easily used at least twice.

• Verify that your home is leak free. Many homes have hidden water leaks. Read your water meter before and after a two hour period when no water is being used. If the meter does not read exactly the same, there is a leak.

• Repair dripping faucets. If your faucet is dripping at a rate of one drop per second, you can expect to waste 2,700 gallons per year. This adds to the cost of water and sewer utilities and adds to your water bill.

• Retrofit all household faucets by installing aerators

with flow restrictors to slow the flow of water.

• Insulate your water pipes. You’ll get hot water faster and avoid wasting water while it heats up.

• If you have a well at home, check your pump periodically. Listen to hear if the pump kicks on and off while water is not being used. If it does, you have a leak.

• If you can afford it, redirect your grey water plumbing to a storage outdoors for watering your yard.

• Some of the tips mentioned here will take some time to get used to. Once digested and used to, a faucet with running water rushing out of control, will be devastation to the ears.

Bathrooms

• Inside your house, bathroom facilities claim nearly 75% of the water used.

Toilets

• Check for toilet tank leaks by adding food coloring to the tank. If the toilet is leaking, color will appear in the toilet bowl within 30 minutes.

• Check the toilet for worn out, corroded or bent parts. Most replacement parts are inexpensive, readily available and easily installed. (Flush as soon as test is done, since food coloring may stain tank.)

• If the toilet handle frequently sticks in the flush position letting water run constantly, replace or adjust it.

• Install a toilet dam or displacement device such as a brick, bag or bottle to cut down on the amount of water needed for each flush. Be sure installation does not interfere with the operating parts.

bag or bottle to cut down on the amount of water needed for each flush. Be sure installation does not interfere with the operating parts.

• Avoid flushing the toilet unnecessarily. Dispose of tissues, insects and other similar waste in the trash rather than the toilet.

• Some toilet users flush their overnight deposits in the morning. Some people flush by pouring recycled gray water rather than using the toilet tank lever.

• When purchasing new or replacement toilets, consider low volume units which use less than half the water of older models. In many areas, low volume units are required by local building codes.

• Dual flush toilets  use two buttons or handles to flush different amounts of water. However, due to the more complex mechanism, they are more expensive than low flush toilets. Dual flush toilets are required by building codes in some countries.

use two buttons or handles to flush different amounts of water. However, due to the more complex mechanism, they are more expensive than low flush toilets. Dual flush toilets are required by building codes in some countries.

• The bidet is a wonderful plumbing fixture used worldwide. Its purpose is to wash anything below the waist. Bidets will also diminish dramatically the number of falls by the elderly.

is a wonderful plumbing fixture used worldwide. Its purpose is to wash anything below the waist. Bidets will also diminish dramatically the number of falls by the elderly.

Showers

• Take shorter showers. Replace your showerhead with an ultra low flow version. Some units are available that allow you to cut off the flow without adjusting the water temperature knobs.

• Place a bucket in the shower to catch excess water while showering. This grey water can be used to water plants.

to catch excess water while showering. This grey water can be used to water plants.

• While waiting for the water to warm up, rescue the water from the bathtub faucet with a large jug or bucket. When warm, use the shower. The rescued water in the jug is potable and could water fruit trees.

or bucket. When warm, use the shower. The rescued water in the jug is potable and could water fruit trees.

• When showering, turn water on to get wet; turn off to lather up; then turn back on to rinse off. Repeat when washing your hair or shave.

Sinks

• When washing the face, plug the sink. That water can be used to shave and pre rinse.

• Turn off water when brushing your teeth.

Kitchens

Dish washing

• Operate automatic dishwashers and clothes washers only when they are fully loaded. Set the water level for the size of load you are using.

• When washing dishes by hand, fill one sink or basin with soapy water. Quickly rinse under a slow moving stream from the faucet.

• When washing dishes by hand, rinsing with hot water will make the soap melt away faster.

• A most efficient way of doing dishes by hand is to have a small bowl inside the sink and a good size jug on the side. Dishes are soaped with a trickle of water and all rinsing occurs over the bowl. This grey organic water is dumped into the jug and used for landscaping as needed. The grey water can also be used to operate the sink disposal which would require lots of water to operate properly.

and a good size jug on the side. Dishes are soaped with a trickle of water and all rinsing occurs over the bowl. This grey organic water is dumped into the jug and used for landscaping as needed. The grey water can also be used to operate the sink disposal which would require lots of water to operate properly.

• When washing a pan with lots of grease or lard, remove such with a paper towel prior to washing.

Sink

• Store drinking water in the refrigerator. Don’t let the tap run while you are waiting for cool water to flow.

• Do not use running water to thaw meat or other frozen foods. Defrost food overnight in the refrigerator or use the defrost setting on your microwave.

• Start a compost pile as an alternate method of disposing of food waste, instead of using a garbage disposal. Garbage disposals also can add 50 percent to the volume of solids in the sewer system or they can lead to problems with a septic tank.

Water Heater

• Consider installing an instant water heater on your kitchen sink so you don’t have to let the water run while it heats up. This will reduce water heating costs for your household.

• If you do not have an instant heater for the sink, keep a large jug handy and rescue the warming potable water. This clean water has many uses and it is water that otherwise would go down the drain. Do not drink water from a water heater.

Typical water use at home

(as per USGS):

Bath: A “full tub” varies, but 36 gallons is a good average amount.

Shower: 20-50 gallons every 10 minutes. Older showers can use up to 5 gallons of water per minute. Water-saving shower heads produce about 2 gallons per minute.

Toilet Flush: 3 gallons. Most all new toilets use 1.6 gallons per flush, but many older toilets up to 4 gallons.

Brushing Teeth: Newer bath faucets use about 1 gallon per minute, whereas older models use over 2 gallons.

Hands Washing: 1 gallon

Face/leg shaving: 1 gallon

Dishwasher: 6 (newer) to 16 gallons (older)

Dishwashing by hand: About 8-27 gallons. Depending on how efficient you are at hand- washing dishes. Newer kitchen faucets use about 1.5-2 gallons per minutes, whereas older faucets use more.

Clothes Washer: 25 gallons/load for newer washers. Older models might use about 40 gallons per load.

Outdoor watering: 2 gallons per minute, depending on the force of your outdoor faucet.

Garage

• A utility sink in the garage is a wonderful source for recycled water. Leave a 3 gallon bucket at all times and you will notice that most of the water you’ll use is just fine as grey water.

Leave a 3 gallon bucket at all times and you will notice that most of the water you’ll use is just fine as grey water.

• Place the drain hose of a clothes washer into this plastic hose  and

and

run it to a storage container. Just washing the bedding will fill the 64 gallon container shown at least 3 times.

The hose if long enough, can also water the landscape as it is draining the washer.

This hose is 24’ long and it pays for itself many times over.

Outdoors

• When washing the car, use soap and water from a bucket. Use a hose with a shut off nozzle for the final rinse.

• Use a broom to clean your driveway.

• Drought tolerant plants are more than just cacti! For landscaping, use native or other low water use plants. Check with your local nursery for the best native or low water use trees, shrubs and plants.

• Using a layer of 2-3”mulch around plants reduces evaporation and promotes plant growth. Water retaining basins also allow water to be concentrated around the plants.

• When mowing, raise the blade on your lawn mower to at least three inches high, or to its highest level. Closely cut grass makes the roots work harder, requiring more water.

• Drip irrigation exceeds 90 % efficiency while sprinkler systems are 50 to 70 % efficient.

Install a water efficient drip system to irrigate trees, shrubs and flowers to get water to their root system.

• Stack potted plants so that when one drips, it waters the one below.

• When watering potted plants, use a jug or bucket. This will give you an exact feel of how much water you have given the plant.

• To trap rain water for landscaping, use empty garbage cans under the eaves that have no gutters.

For roofs with gutters, connect a large hose to the gutter where the down spout would be connected and store that water in a cistern.

Irrigation

• Adjust sprinklers so only the lawn is watered and not the house, sidewalk, or street. Check and maintain your sprinkler system regularly.

• Do not water on windy days.

• A heavy rain means you don’t have to water at all. Teach the family how to turn off an automatic sprinkler system in case a storm comes up during the sprinkling cycle.

• Adjust your irrigation schedule to accommodate changes in seasonal water demand. Install an automatic timer.

• Always water during the coolest time of the day to minimize evaporation. Early morning is best, and the peak water consumption hours (4 p.m.-9 p.m.) should be avoided.

• Buy a rain gauge to determine how much rain or irrigation your yard has received.

• Minimize grass areas in your yard because less grass means less water demand. Replace with low water use landscaping.

Final Tips

Use less water and you will extend the life of your septic system, water heater, washing machine and other appliances.

You will minimize pollution and extend the life of this planet.

You will save on electrical for heating fresh water and you will save on your local water department bill until rates will increase to support infrastructure and employees’ pensions.

Water will get much more expensive!

Featured image above compliments of howstuffworks.com